Do I Need Gap Insurance?

Do I Need Gap Insurance?

Before we can answer the question, “Do I need Gap Insurance?” It's important to understand what Gap Insurance actually is.

What is Gap Insurance?

Gap Insurance comes in a variety of Policy types but in its essence, Gap Insurance protects both new & used car owners for any vehicle depreciation should a vehicle be written off by the main insurer or stolen (declared a total loss).

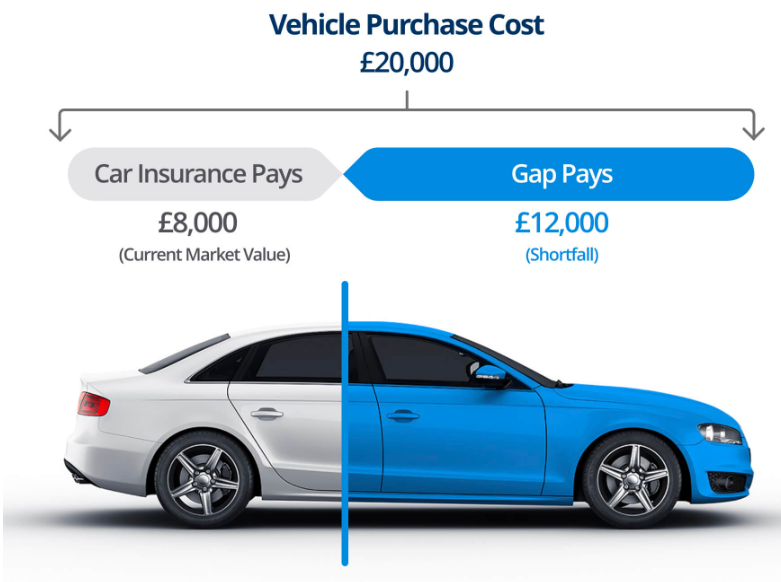

For example, if you purchased a vehicle for £20,000 and it was written off or stolen and the vehicle’s market value had depreciated to just £8,000, this is the amount your Car Insurance company would pay out, leaving you with a £12,000 shortfall. However, if you had a Return to Invoice (RTI) Gap Insurance Policy, it would cover the difference between what your Car Insurance company paid to you and the original purchase price. In this example, the Gap Insurance Policy would pay out £12,000.

Do I Need Gap Insurance if I purchase my car on Finance?

It is certainly worth seriously considering purchasing Gap Insurance if you have bought your vehicle via Finance such as Personal Contract Purchase (PCP) or Hire Purchase (HP). The reason being is that if your car was written off or stolen and the value of the vehicle is less than that owed to your Finance company, it would result in you paying the outstanding amount out of your own pocket. Potentially paying your own money out for an incident that was not your fault or beyond your control.

"If you purchase a nearly-new car, up to four years old, you will be purchasing it during the fastest depreciation period and therefore may want to seriously consider Gap Insurance."

How long does a Gap Insurance Policy cover me?

Unlike Car Insurance which is typically purchased then renewed every 12 months, Gap Insurance conveniently covers drivers from 1-5 years. In other words you can match the length of your Gap Insurance Policy with the length of your Finance arrangement or the time you expect to keep the vehicle, giving you peace of mind for the duration of your ownership.

What are the different types of Gap Insurance cover?

There are three types of Gap Insurance that vary in suitability depending on your circumstances and how much cover you want:

- Finance/Contract Hire/Lease Gap Insurance. For those that purchase a vehicle using finance however any three of these Policies can be purchased. In the event of your vehicle being declared a total loss, a Finance/Contract Hire/Lease Gap Insurance will pay the difference between the outstanding finance balance and the motor insurer’s settlement.

- Return to Invoice Gap Insurance. Sometimes known as 'Back to invoice’ Gap Insurance, this Policy pays the difference between the motor insurer’s settlement and the purchase price paid for your vehicle. This Policy can also be used by those who purchased their vehicle via a Finance arrangement.

- Vehicle Replacement Gap Insurance. This Policy is typically more expensive than Return to Invoice and Finance Gap Insurance for a good reason. It will pay the difference between the motor insurer’s settlement and the cost of a replacement vehicle matching the original model’s specification. This Policy can also be used by those who purchased their vehicle via a Finance arrangement. This gives additional cover if the replacement value of the vehicle has increased in price.

Do I need Gap Insurance for a used car?

Gap Insurance protects the value of a car as it depreciates and while it is true that used cars depreciate slower than a brand new car, they still depreciate.

An article written by the AA states that a new car loses value as soon as it is driven off the forecourt and will typically lose 40% of its value in the first year. A car doing 10,000 miles a year will on average lose around 60% of its value after three years.

If you purchase a nearly-new car, up to four years old, you will be purchasing it during the fastest depreciation period and therefore may want to seriously consider Gap Insurance.

If the car is older than three years but you’re still doing high mileage you still may want to consider Gap Insurance.

So the question to ask isn’t, “Do I need Gap Insurance for a used car?” It’s more useful to answer:

- How old is the used car?

- How long do I plan on keeping my car?

- How much mileage do I plan to do?

It’s worth keeping in mind that by the time a car is eight years old it has depreciated to a more stable level. An older car comes with its repair risks but at the same time it could be comforting to know it shouldn’t drop much further in the future. Again this depends on your mileage and how much you care for the vehicle!

So do I actually need Gap Insurance? Is Gap Insurance unnecessary?

Unlike Motor Insurance, Gap Insurance isn’t mandatory however it certainly protects new car owners, nearly-new car owners (up to four years old) and high mileage drivers from the inevitable depreciation that will occur.

For owners of older vehicles and with high mileage, most of the depreciation has already occurred so Gap Insurance may not make as much sense. However it is not to say that further depreciation will not occur but it’s unlikely it would be at the same rate of a new or nearly new vehicle.

Car owners with finance agreements may want to think separately about the depreciation aspect of their vehicle in case they end up owing their finance company a large sum of money if the vehicle was to be written off during the payback period.

Still unsure if you need Gap Insurance?

After reading this article we now hope you have a better idea whether you need Gap Insurance or not. Fear not if you are still unsure. You can call the friendly and helpful, UK-based Direct Gap customer service for some honest advice surrounding your own circumstances and to ask us directly, “Do I need Gap Insurance?”.