How To Get The Best PCP Deal

Quick Links

- 1 Minute Read: Finding the Best PCP Deal

- Introduction

- Why Would You Be Refused Car Finance (Like PCP)?

- Is PCP Financing The Best Way To Buy A Car?

- What Exactly Is A PCP Deal?

- Know Your Car’s Value (And The Market)

- The Importance Of The Deposit

- Check The APR

- Negotiate The Guaranteed Future Value (GFV)

- Be Realistic About Mileage

- Don’t Forget About GAP Insurance

- Check For End-Of-Term Fees

- The Bottom Line

On The Hunt For A Bargain PCP? Read On…

1 Minute Read: Finding the Best PCP Deal

PCP (Personal Contract Purchase) remains one of the most popular ways to finance a new car, but not all deals offer good value. The key to finding a genuine bargain lies in understanding how PCP works and knowing where to look for savings.

Before signing anything, research the car’s market value to strengthen your negotiating position and ensure the price aligns with real-world figures. Pay attention to the deposit amount and APR, even a small difference in interest can add up over the term. Be realistic about your mileage, too, since exceeding limits can lead to hefty end-of-term charges.

Don’t overlook Gap Insurance. If your car is written off or stolen, it bridges the shortfall between your insurer’s payout and what you still owe on finance, a small cost that can save you thousands.

Bottom line: A great PCP deal isn’t just about low monthly payments; it’s about understanding the full picture, from deposit to balloon payment. Compare offers, read the fine print, and negotiate with confidence to make sure your next car truly fits your budget and your needs.

Introduction

If you’ve ever thought about upgrading your car but don’t want to pay the full price upfront, a Personal Contract Purchase (PCP) might seem like the perfect solution.

It’s flexible, relatively affordable, and has become one of the most popular ways for UK drivers to finance new cars (accounting for around 90% of all car finance in the UK). But here’s the catch: not all PCP deals are created equal.

To make sure you’re getting the best possible value (and not overpaying in the long run), it’s worth understanding how PCP works and where the real savings can be found.

That’s exactly what we’re covering in this guide. First, though, let’s answer some of your PCP questions and cover the basics.

Why Would You Be Refused Car Finance (Like PCP)?

Poor credit history is the main reason buyers are refused finance, which is usually caused by missing payments, too many finance applications in the past and defaulting on existing loans. As well as this, lenders are reluctant to provide PCP financing to people who have a low affordability score, which means their income is too low to feasibly afford repayments.

If you are refused or rejected car finance, you can contact the provider for a greater understanding and explanation of their decision. Ultimately, lenders have to be responsible, so they can’t accept everyone. If your finance application is rejected, it’s to protect both the finance company and you.

Is PCP Financing The Best Way To Buy A Car?

Which type of financing (if any) is ‘best’ for you depends on your circumstances. Any dealership or finance provider that labels their offering ‘the best’ is being disingenuous and irresponsible.

Leasing, PCP, HP or buying outright are all good options if they suit your needs.

What Exactly Is A PCP Deal?

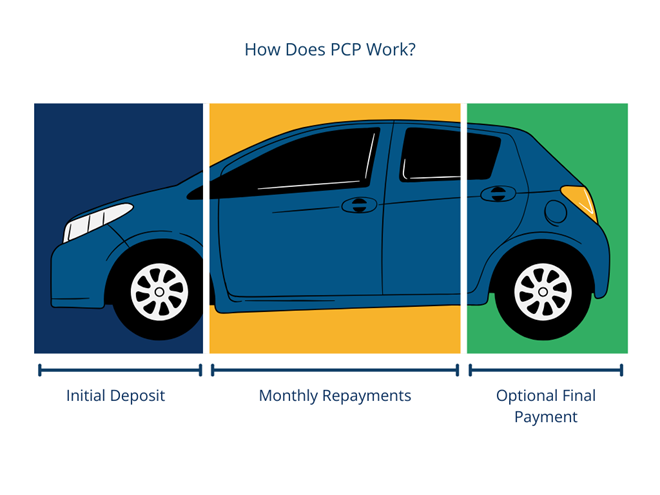

At its core, a PCP deal lets you spread the cost of a car over a set term, usually between two and four years. You’ll make monthly payments that cover the car’s depreciation (not its full value), followed by a final optional “balloon” payment if you want to buy the car outright.

When the term ends, you’ve got three choices:

- Pay the final payment and keep the car.

- Hand the car back and walk away.

- Trade it in for a new one, starting a new PCP deal.

This flexibility is what makes PCP so appealing, but it also opens the door to confusion and, sometimes, hidden costs if you’re not careful. The key is to understand what you’re paying for and negotiate from a position of knowledge.

You can find more details about how PCP finance works from trusted resources like MoneyHelper and the Financial Conduct Authority (FCA).

Know Your Car’s Value (And The Market)

Before you even think about signing a deal, research the car’s market value, both new and used. Knowing what the model typically sells for gives you leverage when it comes to negotiating the purchase price, which directly affects your monthly payments.

Websites like Auto Trader offer free valuation tools that can give you a ballpark figure for most makes and models. Remember, dealers often build profit margins into PCP offers, so understanding the true value of the car helps you spot whether you’re getting a fair deal.

The Importance Of The Deposit

Your deposit (or “advance payment”) plays a huge role in what you’ll pay each month. The more you put down initially, the less you’ll owe over the term. Many people overlook this and accept whatever deposit a dealer suggests, but it’s worth tweaking to see how it changes your total cost.

A good rule of thumb is to put down around 10–20% of the car’s value if you can afford it. Anything less and your monthly payments (and interest) will likely increase.

Check The APR

APR, or Annual Percentage Rate, tells you how much interest you’re paying on the deal. Even a small difference in APR can add up to hundreds of pounds over the course of your agreement.

Always ask the dealer for a full breakdown of the interest and any admin fees. Don’t be afraid to compare offers from multiple dealerships or online brokers. Many comparison platforms, such as Carwow and What Car?, allow you to check live PCP quotes across different brands and lenders.

Pro tip: Manufacturer PCP offers often come with promotional APRs (sometimes 0%), but they may also tie you into higher purchase prices or optional extras you don’t need.

Negotiate The Guaranteed Future Value (GFV)

The Guaranteed Future Value (GFV), sometimes called the “residual value”, is what the finance company estimates the car will be worth at the end of your term. This figure affects your monthly payments and final balloon payment.

If the GFV is too high, you’ll pay less each month but may face a bigger final payment. If it’s too low, your monthly costs rise, but you might end up with some equity to roll into your next car. Striking the right balance depends on whether you plan to keep the car or hand it back.

Keep an eye on the car’s predicted depreciation. You can use guides like CAP HPI to get realistic future value estimates.

Read More: Everything You Need To Know About HPI Checks.

Be Realistic About Mileage

Mileage limits are where many PCP customers get caught out. Most contracts include an annual mileage allowance, often between 8,000 and 12,000 miles. Go over this, and you’ll be charged per mile, sometimes up to 10p–15p each.

If you regularly do long commutes or road trips, it’s better to choose a higher mileage limit from the start. Yes, it might increase your monthly payments slightly, but it’ll save you from a hefty bill at the end.

Don’t Forget About GAP Insurance

One cost that’s often overlooked in the excitement of a new car is GAP insurance. It covers the difference between what your insurer pays if the car’s written off or stolen and what you still owe on the finance.

If your PCP car is brand new, it can lose around 20% of its value in its first year, according to Auto Express. That means without GAP cover, you could be left paying off finance for a car you no longer have, so it’s worth considering insurance like Return To Invoice Insurance, which is suitable for PCP.

You don’t have to buy GAP insurance from the dealer, in fact, it’s often cheaper to buy it privately.

Check For End-Of-Term Fees

Before you sign, read the fine print about return conditions.

PCP agreements often include clauses about fair wear and tear, with extra charges for scratches, dents or interior damage.

The British Vehicle Rental and Leasing Association (BVRLA) offers detailed guidelines on what counts as acceptable wear and tear, so it’s worth familiarising yourself early to avoid nasty surprises later.

Whilst charges are few and far between, they can be significant if you’re not prepared. To help, we’ve put together a guide on Common PCP Mistakes (That Could Cost You Money).

The Bottom Line

Getting the best PCP deal isn’t just about finding the lowest monthly payment; it’s about understanding the total cost, from start to finish.

Do your homework, compare offers, and question everything that doesn’t add up. The best deals are rarely the ones pushed hardest by dealers, but the ones where you’ve taken the time to understand every figure on the page.

With a little preparation (and some well-timed negotiation), you can drive away knowing you’ve got a fair deal, and a car you’ll genuinely enjoy. Remember, the best deal is the one that suits your needs.

We hope you’ve enjoyed reading. If you have, don’t forget to share this guide! And, as always, get in touch with us via social media if you have any questions.

Pin It!