Everything You Need To Know About HPI Checks

Understand HPI Checks & Protect Yourself With Your Next Used Car Purchase

Quick Links

- 1 Minute Read

- Introduction

- How Much Difference Is There Between New & Used Car Depreciation?

- Can A Car Be Bought Or Sold With Outstanding Finance?

- Everything You Need To Know About HPI Checks

- Our Final Word

1 Minute Read

Buying used can save thousands, but it also carries risks, including hidden finance and stolen plates to write-offs and mileage fraud. An HPI check is a low-cost way to protect yourself.

For around £10–£20, you’ll get a full vehicle history, including finance status, theft records, insurance write-off categories, mileage accuracy, previous owners, and spec verification. It can prevent costly mistakes like buying a repossessable car or overpaying for one with accident damage.

While reputable dealers usually run these checks, never assume. Always ask for proof or do your own. Private buyers should treat it as essential, not optional.

Bottom line: An HPI check won’t replace a test drive or inspection, but it’s your first line of defence against scams and legal headaches. For the price of a takeaway, it could save you thousands.

Introduction

Buying a used car can be a smart financial move; until it isn’t. While second-hand vehicles offer better value, lower depreciation, and often cheaper insurance, they can also come with hidden problems.

We’re not just talking about worn tyres or a few scratches; there could be bigger issues, such as outstanding finance on the vehicle, stolen registrations, insurance write-offs, and mileage discrepancies.

That’s where an HPI check can prove useful. But what exactly is it, and is it really worth the money? In this guide, we’re answering just that.

First, let’s cover the basics.

How Much Difference Is There Between New & Used Car Depreciation?

Whilst depreciation levels can vary, depending on factors such as mileage, damage and market changes, an average car will typically lose 15-35% of its total value in the first year, 35-50% in the second and 50% or more in the third year.

Used cars still experience high levels of depreciation; however, the overall value loss tends to be lower and the car’s initial price is cheaper.

Let’s take a Volkswagen Golf as an example. New ones can be picked up for around £39000. That means you could buy one, drive it for a year and be set to lose anywhere between £5850 and £13650.

Buying that same car a year later saves you that money. Sure, both the new and used cars will still depreciate in the second year, but your overall losses on the used model are much lower.

If you're considering buying a new (or used) car and worry about depreciation, there are two things you can do. Firstly, take a look at our Depreciation Calculator, which will calculate the approximate depreciation you’re set to experience. Secondly, look into Gap Insurance, which provides financial protection from depreciation if your car is ever written off.

Can A Car Be Bought Or Sold With Outstanding Finance?

In short, no.

If a car has outstanding finance on it, such as a hire purchase or pcp agreement, then it still technically belongs to the finance company. Selling it with outstanding finance is illegal, and you must pay off the amount in full before putting your car on the market.

Whilst this is the case for buying too, some unscrupulous sellers will try to offload a car with outstanding finance. That could leave you massively out of pocket and at risk of having your car repossessed.

We’ve covered this in more detail. If you want to find out more, read about Buying, Selling & Trading In A Car With Outstanding Finance.

Everything You Need To Know About HPI Checks

What Is an HPI Check?

An HPI check is a comprehensive background report on a used vehicle, helping you confirm that the car you're about to buy is genuinely roadworthy, legally owned, and free from financial baggage.

The term “HPI check” comes from Hire Purchase Information Ltd, one of the UK’s longest-standing vehicle checking services. It’s now used more generically to describe any detailed vehicle history report.

It typically includes data such as:

- Outstanding finance

- Whether the car’s been written off by an insurer

- If it’s been reported stolen

- Mileage inconsistencies

- Number of previous owners

- Plate changes or colour changes

- Whether it's been scrapped

- MOT history

- Vehicle specifications

Many HPI-style checks also include a vehicle valuation, helping you know whether you're paying a fair price.

Why Is It Important?

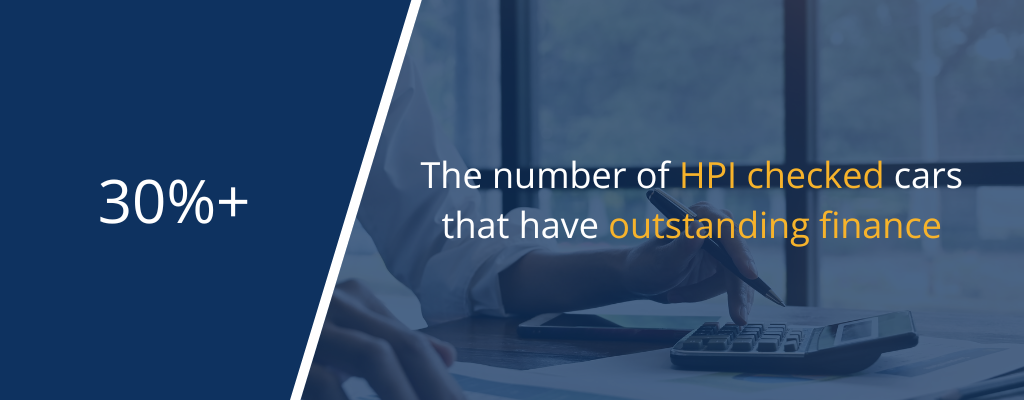

It’s shockingly easy to buy a car that still legally belongs to a finance company. In fact, according to figures reported by Auto Express, roughly 1 in 3 used vehicles checked had some form of issue that could have cost the buyer dearly.

Buying a used car without knowing its full history could mean:

- You end up paying off someone else’s finance

- The car gets repossessed

- It’s stolen and seized by the police

- It’s unsafe to drive due to undisclosed accident damage

- You overpay for a car with a misleading history

With all that in mind, a £10–£20 HPI-style check suddenly seems like a very wise investment.

Dont' be caught out with outstanding finance.

What Does an HPI Check Show?

Let’s look in more detail at some of the key elements:

Outstanding Finance

If the previous owner hasn't finished paying off their car finance, the lender still legally owns the car. If you buy it, the lender can reclaim it, and you're unlikely to get your money back.

Insurance Write-Offs

Cars that have been declared a total loss by insurers can be put back on the road, but not always safely.

An HPI check will tell you whether the car was a Category S (structurally damaged) or Category N (non-structural damage).

Not all sellers disclose this and it can significantly affect resale value and safety.

Read More: Different Car Write Off Categories Explained

Stolen Vehicle Record

Yes, people do try to sell stolen cars. An HPI check runs the reg through the Police National Computer to flag any theft records.

If you’re at the research stage of your car-buying journey, why not take a look at our list of the Top 10 Most Stolen Cars. Maybe it will rule a few out of the running?

Mileage Check

Clocking a car (rolling back the mileage) still happens, despite being illegal. An HPI check cross-references DVLA and MOT data to identify mileage discrepancies.

Vehicle Identity & Specification

It’s not uncommon for a car’s reg to be cloned. A proper check matches the registration, Vehicle Identification Number (VIN), and engine number to ensure you’re looking at the right vehicle.

Where Can You Get One?

While HPI Ltd is the original provider, there are several reputable services offering similar reports, often at lower prices. Options include:

Pro tip: Some providers offer free basic checks, but the full picture (including outstanding finance) usually requires a paid report.

Is It Worth Paying For?

If you’re buying privately, then yes, absolutely. Even experienced buyers can miss warning signs. A proper check ensures the car you’re buying is safe, legal, and as described.

Even when buying from a dealer, it’s worth asking if they’ve done one and requesting a copy. If they haven’t, do your own.

In most cases, £10–£20 is a small price to pay for peace of mind, especially when you're about to hand over thousands of pounds.

Do Dealers Have to Run HPI Checks?

Reputable dealers will almost always conduct an HPI check as part of their prep process. It protects them as much as it protects you. However, not all do, especially at the budget end of the market.

If the dealer hasn’t already done one, take that as a red flag.

Our Final Word

An HPI check might not be the most exciting part of buying a car, but it’s one of the most important. It acts as your line of defence against financial liability, unscrupulous sellers, and hidden surprises.

While it’s not a guarantee that nothing will go wrong (you should still inspect the car and take it for a test drive), it dramatically reduces your chances of being caught out.

Put simply, if you’re not getting an HPI check, you’re taking a risk you don’t need to.

We hope you’ve enjoyed reading this guide. If you are on the hunt for your next car, take a look at our Complete Car Buying Guide. And, as always, don’t forget to share this with your network if you’ve found it useful.

Pin It!